WELCOME TO THE ASSEMBLY LINE METHOD

Learn how to build a Residual (Passive) Income in 3 easy steps!

Henry Ford required Parts for his Assembly Line to build his cars.

We need parts too. Ours is in Part-nership with the right supplier.

Ford's Parts in 1913 relative to the Assembly Line Method in 2025

Engine and Fuel (Product & Services) - The engine is the core product or service (catalyst) that powers the entire operation, fundamental to the sustainability of the vehicle, whether it's the Model T or Residual income.

Transmission (Compensation Plan) - Like the car's transmission, the compensation plan determines how rewards and profits are distributed, crucial for performance.

Frame and Body (Business Structure and Brand Identity) - Combining the structural support of the frame with the aesthetic and functional elements of the body, this aspect relates to the organizational framework. This includes the legal structure, corporate identity, and the visual and cultural elements that define the efficiency of the vehicle/system.

Wheels and Tires (Logistics and Distribution Strategies) - These are the means by which the company moves forward and delivers products. Effective distribution strategies are like wheels and tires that allow the company to provide the products to collective (and customers).

Support Systems (Training, Compliance, and Operational Efficiency) - This encompasses everything from the suspension, which absorbs bumps (training and support), to the brakes (compliance with legal standards), and the radiator (ensuring the business operates efficiently without overheating). These systems collectively ensure the network runs smoothly, adheres to regulations, and supports its members effectively.

Final output - The Vehicle (Residual Income) - Just as Ford's Model T rolled off the assembly line each new car buyer could now travel to new places like never before, our assembly line method provides the member the opportunity of receiving a steady flow of Residual, Passive Income. Income that will provide them with a lifetime to explore the world they never thought possible.

We put the right parts on our Assembly Line to get the Vehicle we want - Residual Income!

Look at this chart below. Having a Residual Income stream could be right for you.

What are the Challenges? What are the Benefits?

Top 10 Challenges of "Lack of Income"

Perpetual Financial Precipice: The relentless fear of falling into debt with every paycheck, unable to stabilize financially.

Overwhelming Financial Dread: Constant worry over money can lead to debilitating anxiety and depression, overshadowing everyday life.

Health Care Desperation: A stark lack of funds can mean foregoing necessary medical care, leaving one vulnerable to worsening health conditions.

Crisis Vulnerability: The terror of facing unexpected expenses with no safety net, potentially leading to financial ruin with each emergency.

Compromised Living Conditions: The fear of continually having to lower living standards, impacting well-being and personal safety.

Debt Spiral: The nightmare of becoming trapped in a cycle of high-interest debt, with credit as the only means to manage basic living expenses.

Stifled Potential: The frustration and fear of being unable to pursue educational or career opportunities that could break the cycle of poverty.

Social Isolation: The painful reality of having to decline social outings and community involvement, leading to loneliness and a sense of exclusion.

Future Foreclosed: The daunting realization that saving for long-term goals like home ownership or retirement is just a dream, out of reach.

Endless Instability: The constant fear of unpredictable financial challenges, making life seem like an unending battle for survival.

Top 10 Benefits of Residual Income

Financial Freedom: Embrace the power to shape your own destiny, making choices that align with your deepest desires rather than financial limitations.

Stress-Free Living: Experience the profound peace and joy that come from knowing your financial health is secure, freeing you from the burden of money-related worries.

Early Retirement Options: Unlock the possibility of retiring on your own terms, giving you the time to pursue passions that bring you happiness and fulfillment.

Ready for Anything: Equip yourself with the resources to handle life's unexpected turns confidently, ensuring you’re prepared for any emergency.Investment

Opportunities: Leverage your financial advantage to grow your wealth through strategic investments, expanding your possibilities for future success.

Generosity and Impact: Utilize your financial abundance to make meaningful contributions to the lives of others, enhancing your sense of purpose and connection.

Elevated Lifestyle Choices: Indulge in a higher standard of living, enjoying superior comforts and experiences that enrich your life every day.Career

Fulfillment: Choose to work in a field you love, not because you need to, but because it adds value and joy to your life, enhancing your professional satisfaction.

Inner Peace: Savor the tranquility that comes with financial stability; a calm mind allows you to focus on personal growth and happiness.

Legacy Creation: Build a legacy that reflects your values and visions, leaving a lasting impact that benefits future generations and fulfills your life’s purpose.

Which one would make the best sense for you?

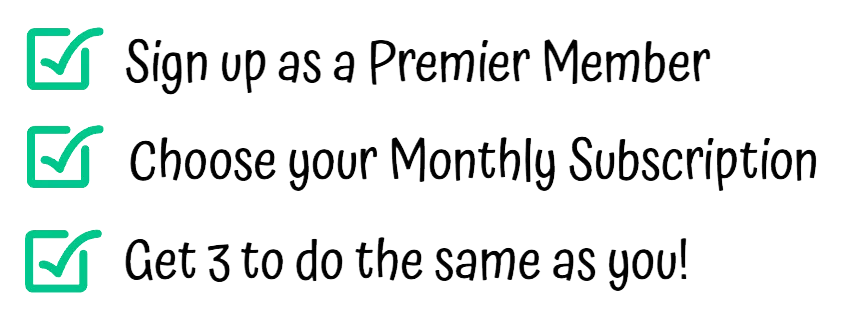

Now you've learned the 3 easy steps.

Duplicate it like Ford!

Can it be that easy? Henry Ford broke his car down to 84 Steps and reduced the time. He just DUPLICATED the model. Thankfully our tasks are much simpler than that. Just 3 steps. And you can do this in a lot less time.

Think about the steps. In real time. How long will it take you to do them? Do you have 10 minutes? Wait, what?

• Sign up - :30 Seconds

• Choose Subscription Options - A minute or so.

• Sharing the video - About 8 minutes.

Disclaimer

All monetary examples are for illustration purposes only and are not a guarantee of income. Results depend on personal efforts.

All income is generated from product sales. All documentation is for Educational Purposes Only.